Hi guys, Natalie, with DIY Bookkeeping, coming to you today from sunny and a little bit windy Southern California. I hope you're doing well.

We're going to discuss the

9 Steps to Process your Payroll, the Right Way!

We want to help you understand what you have to do so that you can set your payroll system up properly and continue forward doing it accurately and on time.

These nine steps start with the following:

1. Verifying the work eligibility of a new employee.

Then you need to make sure that you've completed all of the appropriate payroll tax forms. You verify the employees legally eligible to work in the United States by completing a Form I-9, that you can obtain from the U.S. citizenship and immigration services, by either going to:

www.uscis.gov/forms

Or you can call 1-800-870-3676 to obtain the form and ask any questions you may have about completing it. After you verify that you can hire this individual as an employee, you will move on to completing a Form W-4, which is income tax with-holding form that will help the employee designate how much federal withholding amount they want deducted from their paychecks.

2. Sign up for your Employer Identification Number.

The next thing you need to do prior to processing your first payroll is to sign up for your employer identification number.

You can easily apply for an EIN online by visiting the IRS website at:

https://www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online

This form identifies you as the employer and is used to cross-reference between your payroll and the employee's information and their paychecks so that everything is balanced out at the end of the year, between the employer and the employee.

3. Choose your Payroll Schedule.

You need to choose your payroll schedule. This isn't too difficult. You basically have a variety to pick from, but you'll end up deciding which one works best for you and your company. A payroll schedule is based on a pay period and What is a pay period? It is the recurring length of time over which an employee records time and then gets paid for the time that they worked. Such examples of a pay period would include: Weekly -- Bi-Weekly -- Semi-monthly (2X/month) or Monthly Example: Weekly payroll - The employee will receive 52 paychecks each year for hourly employees. This pay period type is the most common one that is used.

4. Calculate Payroll checks & withhold taxes.

Payments (wages) made to employees are subject to all employment (payroll) taxes. Wages are subject to federal employment taxes (Income Tax Withholding) – Social Security, Medicare, FUTA (Federal Unemployment) and income tax withholding.

Calculating an employee's paycheck can be difficult.

But it doesn't have to be.

There are a variety of online paycheck CALCULATORS that are very useful.

Here is an example of one by PayCheckCity.

https://www.paycheckcity.com/calculator/hourly/

5. Pay Taxes: Deposit taxes withheld from employee and also the Employer portion.

Employers must deposit the federal income tax withheld along with both the employer and employee portions of Social Security and Medicare taxes.

EFTPS is a free service provided by the Treasury Dept. To enroll and get further information, visit EFTPS.gov – https://www.eftps.gov/eftps/

Penalties may apply if you don’t make required deposits on time or if you make deposits for less than the required amount.

6. Process deposits as required.

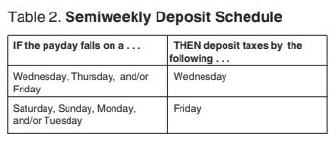

There are two different deposit schedules – monthly and semi-weekly – for determining when you deposit social security, Medicare, and withheld federalincome taxes. An example of when to deposit taxes for a Semi-Weekly Deposit Schedule are:

7. FILE all tax forms & Quarterly Payroll Reports to the appropriate agencies, and on time.

Filing Form 941: Each quarter when you pay wages that are subject to income tax withholding or social security and Medicare taxes, you must file a Form 941.

Federal Unemployment (FUTA) tax:The Federal Unemployment Tax Act (FUTA) provides for payments of unemployment compensation to workers who have lost their jobs. The employer is the only one who has to pay FUTA tax; it isn’t withheld from the employee’s wages.

8. Employee vs. Independent Contractor - "What's the Difference??

What is the difference between an employee and an Independent Contractor?

There are Common-Law rules that help to determine whether an individual is an employee or independent contractor by examining the relationship of the worker and the business owner.

When defining a degree of control and independence the facts fall into three (3) categories:

1. Behavioral control

2. Financial control

3. Type of Relationship

9. Maintain Accurate Recordkeeping.

Keep all records of employment taxes for at least four years after filing the 4th quarter for the year. These should be available for IRS review. Records should

include (but aren't limited to):

Your employer identification number.

Payroll Reports

Employee Files and Reports

Tax Deposits made, etc.