"Mastering the ABCs of Accounting: Understanding Basic Accounting Principles"

Introduction

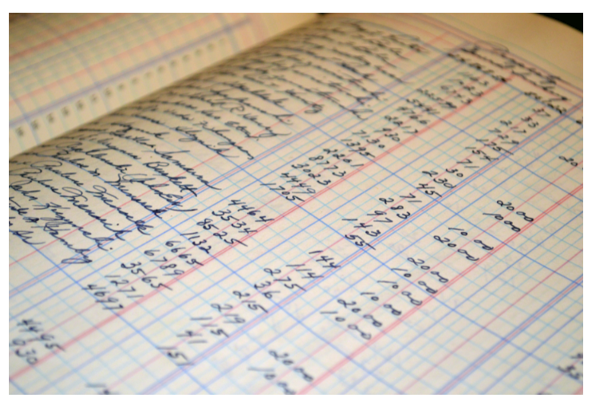

Accounting is often considered the language of business. It provides a systematic way to record, summarize, and communicate financial information. To effectively navigate the accounting world, it's crucial to understand the basic accounting principles that form the foundation of financial reporting.

This blog post will explore ten fundamental accounting principles that every business owner, accountant, and financial professional should know.

These 10 accounting principles are:

a. Debits and credits

b. Accounting equation

c. Accrual vs. cash basis accounting

d. Revenue recognition principles

e. Expense recognition principles

f. Matching principle

g. Cost principle

h. Materiality concept

i. Consistency principle

j. Conservatism principle

a. Debits and Credits

Debits and credits are the building blocks of accounting. They represent the dual-entry system, where each financial transaction affects at least two accounts. Understanding this principle is essential for maintaining the balance in your books. Debits & credits are fundamental accounting concepts that facilitate accurate financial transaction recording.

Debits are entries made on the left side of an account, and they increase asset and expense accounts while decreasing liability and equity accounts. Conversely, credits are made on the right side of an account and increase liability and equity accounts while decreasing asset and expense accounts.

Think of debits and credits like adding and subtracting in math. Debits are like adding money to your account, while credits are like taking money away. They help keep track of what you have and owe.

Debits and credits are like plus and minus signs in math. Debits (+) are used when you add money to your account, and credits (-) are used when you take money out.

This will help make sure your money records are correct.

Consider a business purchasing inventory on credit. In this scenario, the inventory asset account would increase (debit),

and the accounts payable liability account would also increase (credit), ensuring that the accounting equation

(Assets = Liabilities + Equity) remains in balance.

b. Accounting Equation

The accounting equation, Assets = Liabilities + Equity, is the foundation of double-entry bookkeeping. Keeping this equation in balance is crucial for accurate financial reporting. It represents the relationship between what a business owns (assets), what it owes (liabilities), and the residual interest of the owners (equity). This equation ensures that the accounting records stay balanced, providing a reliable snapshot of a company's financial health.

The accounting equation is like a balance scale.

It shows that everything a company owns

(like toys in a store)

equals what it owes to others

(like money borrowed)

plus what's left for the owner.

Accrual accounting is like counting all the chores

you've done, even if you haven't been paid yet.

Cash accounting only counts the money

you've already received.

It's about when you decide to count the work you've done.

c. Accrual vs. Cash Basis Accounting

Accrual accounting records transactions when they occur, not when cash changes hands. Cash-basis accounting, on the other hand, records transactions only when cash is received or paid. Understanding the difference between these two methods is vital for determining the financial health of a business and complying with accounting standards.

Accrual accounting recognizes transactions when they occur, regardless of when cash exchanges hands. This method provides a more accurate depiction of a company's financial performance, aligning revenue and expenses with the period in which they are incurred.

In contrast, cash-basis accounting records transactions only when cash is received or paid, making it simpler but less reflective of a company's financial position.

d. Revenue Recognition Principles

Revenue recognition dictates when and how to recognize revenue in financial statements. It follows the principle that revenue should be recognized when earned and realizable, regardless of when payment is received. This principle ensures that financial statements reflect a company's performance accurately.

Revenue recognition principles dictate when and how revenue should be recorded in financial statements. According to these principles, revenue should be recognized when it is earned, even if payment is yet to be received. This helps prevent manipulating financial statements by timing revenue recognition to present a more favorable financial picture.

Imagine it like this,

You're selling lemonade.

You only say you made money when someone buys it, not when they give you the money.

It's like saying, "I made money because someone wants my lemonade."

e. Expense Recognition Principles

Expenses should be recognized in the period in which they are incurred, matching them with the corresponding revenue. This concept, known as the matching principle, ensures that a company's profitability is not overstated by deferring expenses or understated by recognizing them too early.

The expense recognition principle, closely related to revenue recognition, states that expenses should be recognized in the period they are incurred to match them with the corresponding revenue. This concept is essential for accurately assessing a company's profitability.

When you buy the lemons and sugar for your lemonade,

you only say you spent the money when you use them to make the lemonade.

You don't count it before. It's like saying, "I spent money because I made lemonade."

f. Matching Principle

The matching principle is closely related to expense recognition. It emphasizes that expenses should be matched with the revenue generated in the same accounting period. This principle provides a more accurate representation of a company's financial performance.

The matching principle is a crucial element of accrual accounting and reinforces the idea that expenses should be matched with the revenue they help generate. By doing so, financial statements provide a more precise picture of a company's profit margin and overall performance.

It's like matching socks. You wear them together, right?

So, expenses and the money you make should match in the same time.

If you bought lemons for lemonade, the cost should match with the money you got from selling the lemonade.

g. Cost Principle

According to the cost principle, assets should be recorded at their historical cost rather than their current market value. This principle promotes objectivity and prevents the overvaluation of assets in the financial statements.

The cost principle, also known as the historical cost principle, requires assets to be recorded at their original acquisition cost rather than their current market value. This conservative approach enhances objectivity in financial reporting and reduces the risk of overvaluing assets.

If a company purchases a piece of machinery for $10,000, it would be recorded at that cost,

even if its market value increased or decreased over time.

h. Materiality Concept

The materiality concept states that only significant transactions and items should be reported in the financial statements. In other words, immaterial items need not be disclosed. This principle helps in maintaining the relevance and usefulness of financial information.

The materiality concept directs accountants to focus on significant transactions and items when preparing financial statements. Immaterial items that would not influence a reasonable user's decision-making need not be reported in detail. This principle helps maintain the relevance and conciseness of financial information.

A large corporation may not disclose minor expenses like office supplies individually in its financial statements,

as they are considered immaterial to the company's overall financial health.

Materiality means you only talk about big stuff. If you spend a little bit on candy, you don't need to tell everyone.

It's like saying, "I only tell about the big things, not the small stuff, because small stuff doesn't really matter."

i. Consistency Principle

Consistency in accounting practices is crucial for comparability between financial statements over time. The consistency principle underscores the importance of consistent accounting methods and principles from one accounting period to another. This ensures that financial statements are comparable over time, allowing stakeholders to accurately assess trends and changes in a company's financial performance.

Suppose a company switches from the straight-line depreciation method to the double-declining balance method for its assets. In that case, it should disclose the change and its impact on financial statements to maintain transparency and consistency.

Consistency is like always using the same recipe when baking cookies. It's essential to use the same way of counting money and expenses so everyone understands.

j. Conservatism Principle

The conservatism principle suggests that when faced with uncertainty, accountants should err on the side of caution. This means recognizing potential losses or liabilities promptly while only recognizing gains when they are certain. This principle ensures that financial statements present a more conservative and reliable picture of a company's financial position. The conservatism principle encourages accountants to be cautious when dealing with uncertainties. In cases where there is uncertainty about the outcome of a transaction or an estimate, it suggests taking a conservative approach by recognizing potential losses or liabilities promptly while only recognizing gains when certain. This conservative stance enhances the reliability of financial statements.

For example, if a company faces potential legal liabilities from a lawsuit, it should record the estimated liability even if the outcome is uncertain, reflecting the conservatism principle.

For example, if a company faces potential legal liabilities from a lawsuit,

it should record the estimated liability even if the outcome is uncertain, reflecting the conservatism principle.

Conclusion

These ten basic accounting principles provide the framework for accurate and reliable financial reporting. Whether you're a business owner, accountant, or financial analyst, a solid understanding of these principles is essential for making informed financial decisions and complying with accounting standards. By mastering these fundamentals, you can confidently navigate the complex accounting world and manage your finances effectively.

These expanded explanations of the ten basic accounting principles should clarify their significance in financial reporting and decision-making. By mastering these principles, individuals and businesses can ensure accurate, transparent, and reliable financial statements, contributing to better financial management and informed decision-making.

These simple explanations should help you understand the basic accounting principles better.

They are like rules for keeping track of money and making sure everyone knows what's happening with it.